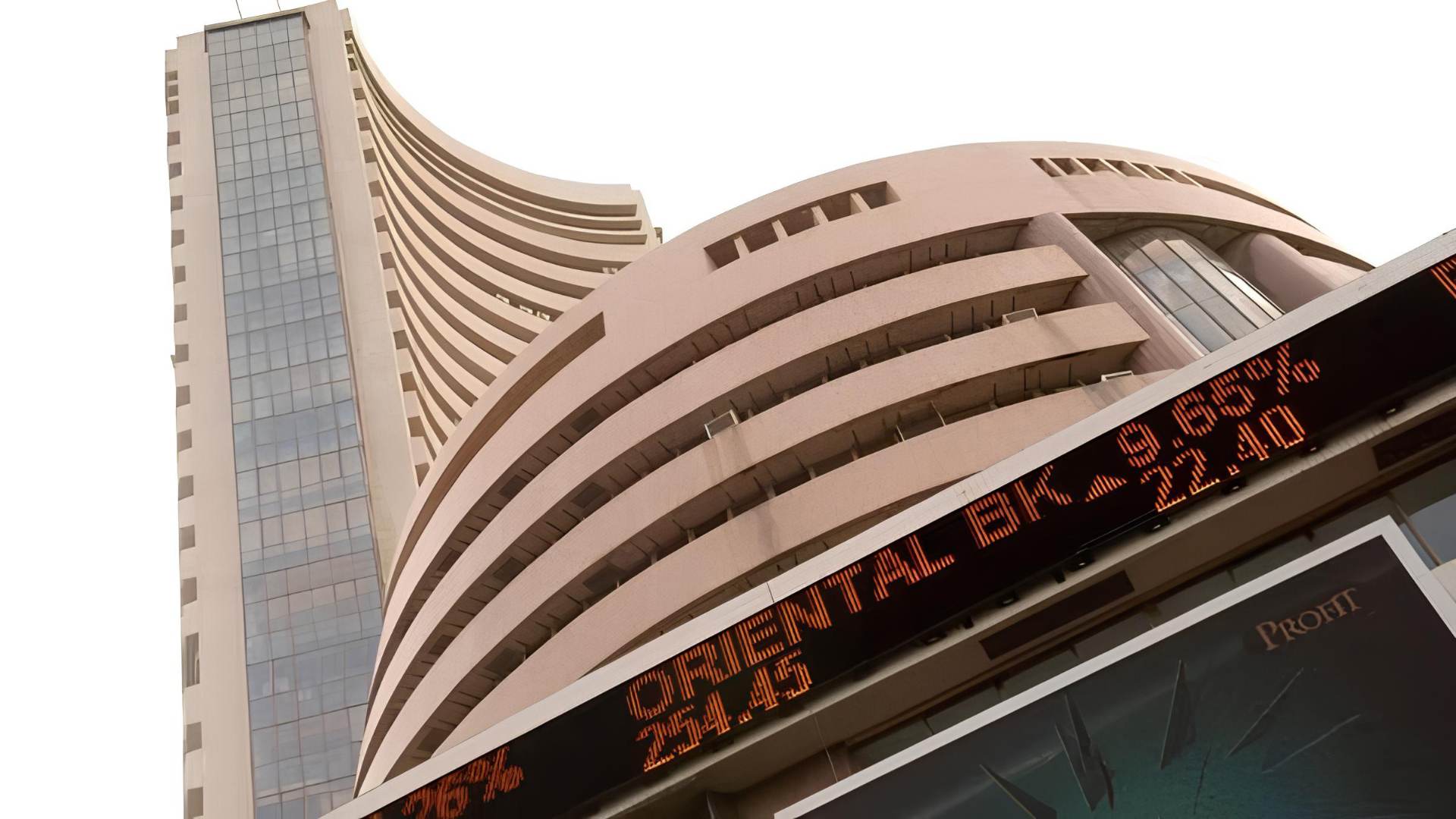

In the world of money, keeping track of how things are going in the stock market is crucial for people who invest and those who just really like money stuff. Today, we’re going to look at how the Nifty 50 and Sensex did on January 20, 2024. We’ll check out what happened with big companies like Reliance Industries (RIL) and Hindustan Unilever (HUL) and how it affected the stock market numbers.

RIL and HUL Quarterly Results

Reliance Industries (RIL)

RIL made a good amount of money in the last three months. They earned ₹19,641 crore, which is 10.9% more than before. Their total money from all their businesses went up by 3.2%, reaching ₹2,48,160 crore. Also, their operating profit (EBITDA) jumped up by 16.7%, settling at ₹44,678 crore, and the profit margin increased to 18%.

Hindustan Unilever (HUL)

Unlike RIL, HUL didn’t make a lot more money. They earned ₹2,519 crore, just a tiny bit more than last year. But, compared to the previous three months, they actually made less, about 7.28% less. Their total income for this time was ₹14,928 crore, which is a little less than before. However, they still managed to grow a bit by 2% in terms of the number of things they sold.

Market Indices Performance

The Nifty 50 and Sensex, which are like report cards for the stock market, didn’t do so well on January 20, 2024. This was because RIL and HUL didn’t impress everyone with their results.

Nifty 50

The Nifty 50 started the day at 21,706.15 and went down a bit to 21,571.80, which is a 0.23% decrease. The companies that didn’t do so well were HUL, TCS, and Mahindra and Mahindra.

Sensex

The Sensex began at 72,008.30 and ended a bit lower at 71,423.65, which is a 0.36% drop. Some of the big companies that dragged it down were TCS, HUL, RIL, Infosys, Mahindra and Mahindra, ITC, and HCL Tech.

Midcaps and Smallcaps Outperform

Even though the big report cards didn’t look great, the mid-sized and smaller companies did better than expected. They actually earned more money and did better than the big companies.

Midcaps and Smallcaps

The BSE Midcap companies went up by 0.46%, and the Smallcap companies went up by 0.41%. This shows that smaller companies can sometimes do even better than the big ones.

Nifty 50 Top Gainers and Laggards

Top Gainers

- Coal India (up 4.11%): Coal India made the most money, going up by 4.11%.

- Adani Ports (up 3.34%): Adani Ports also did really well, going up by 3.34%.

- Kotak Mahindra Bank (up 2.59%): Kotak Mahindra Bank earned more too, going up by 2.59%.

Top Laggards

- HUL (down 3.72%): Hindustan Unilever didn’t do so well, going down by 3.72%.

- TCS (down 2.12%): TCS and Mahindra and Mahindra (down 1.91%): didn’t do great either, going down by 2.12% and 1.91% respectively.

Sectoral Indices Overview

Nifty FMCG and IT Indices

The companies that sell things like soap and technology products didn’t do as well. The Nifty FMCG companies went down by 1.17%, and the IT companies also went down by 1%.

Pharma and Realty Indices

The companies that make medicine and those involved in real estate didn’t do great either, going down by up to 1%. This shows that not every type of company did well on that day.

Nifty PSU Bank and Nifty Bank

On the bright side, banks that are owned by the government (PSU Bank) earned more, going up by 1.86%. Also, the Nifty Bank went up by 0.78%, showing that some parts of the banking world did better.

Expert Views and Technical Analysis

Expert Views

Vinod Nair, who knows a lot about money, said that the stock market wasn’t so busy because of holidays and not many people buying and selling. People made money by selling technology and soap stocks, and they bought some private bank stocks.

Technical Analysis

Rupak De, who is an expert in numbers and patterns, said that the stock market might not change much for a few days, staying between 21,500 and 21,700. If it goes below 21,500, things might not be good, but if it goes above 21,700, it could be really good.

Conclusion

So, on January 20, 2024, the stock market had some good and not-so-good moments. RIL did okay, but HUL didn’t impress many people. Even though the big companies brought the market down a bit, the smaller ones did better. It’s a bit like a puzzle, and people who want to make money need to be careful and smart.

For a picture of what happened, you can look at the diagram below:

graph TD

A[Starting] -->|High| B(Ending)

A -->|Low| C

B -->|Down| D{Market Trend}

C -->|Up| DRemember, the opinions and suggestions here are from people who really know money, but it’s always good to talk to someone certified before making big money decisions.

FAQs

In the last three months, RIL reported a consolidated profit of ₹19,641 crore, showing a robust 10.9% YoY increase. The total revenue across all businesses rose by 3.2% to ₹2,48,160 crore, and the operating profit (EBITDA) surged by 16.7% to ₹44,678 crore with a profit margin increase to 18%.

Unlike RIL, HUL’s standalone net profit for the quarter was ₹2,519 crore, showing a modest growth of 0.55%. However, on a sequential basis, HUL’s net profit declined by 7.28%. The total revenue for Q3FY24 witnessed a marginal 0.38% fall to ₹14,928 crore.

Both Nifty 50 and Sensex exhibited a negative trend on January 20, 2024. Nifty 50 opened at 21,706.15, touched an intraday low of 21,541.80, and closed at 21,571.80, marking a 0.23% decline. Sensex opened at 72,008.30, with an intraday low of 71,312.71, closing 0.36% lower at 71,423.65.

While benchmark indices faced a downturn, midcaps and smallcaps outperformed. The BSE Midcap index rose by 0.46%, and the Smallcap index gained 0.41%, showcasing resilience in the market.

Top gainers in Nifty 50 included Coal India (up 4.11%), Adani Ports (up 3.34%), and Kotak Mahindra Bank (up 2.59%). Hindustan Unilever emerged as the top laggard, experiencing a 3.72% decline, along with TCS (down 2.12%) and Mahindra and Mahindra (down 1.91%).

Nifty FMCG and IT indices declined by 1.17% and 1%, respectively, indicating profit booking. Pharma and Realty indices witnessed declines of up to 1%, reflecting the broader market sentiment. On the positive side, Nifty PSU Bank recorded a robust gain of 1.86%, and Nifty Bank rose by 0.78%, showcasing selective positivity in the banking sector.

Vinod Nair highlighted a subdued market trend due to extended holidays, low volumes, and weekly option expiration. Rupak De suggested a potential consolidation phase within the Nifty range of 21,500-21,700, emphasizing the need for a decisive breakout for a directional move.

The stock market had mixed performances on January 20, 2024. RIL showcased resilience, but HUL didn’t impress. Despite large-cap drags, mid/small-cap outperformance added complexity to the market dynamics, requiring careful navigation in the dynamic landscape.

Follow our Community

Subscribe to our YouTube channel

Unlock a world of benefits with IndiCurrent! Stay informed with insightful newsletters, real-time news alerts, and a personalized news feed. For the latest breaking news and developments from India and around the world, trust IndiCurrent newsdesk to keep you covered. Follow the unfolding drama with us as we delve into the heart of the controversy.

Earn Money💸: Write for us or Share our Post on Social MediaJoin WhatsApp Channel📰: IndiCurrent News